The personal lubricant industry has experienced significant growth in recent years, driven by changing attitudes toward sexual wellness and a growing emphasis on intimacy and pleasure.

This report explores the latest personal lubricant sales statistics, providing insights into consumer behavior, market trends, and opportunities for growth.

We examine the key drivers behind the industry’s expansion, as well as the challenges that manufacturers and distributors face.

About the Lead Researcher

Jacob has a Masters’s Degree in Business Intelligence and several years of experience as a Lead Researcher. His statistics have been brought into all kinds of media: TheHuffingtonPost, Yahoo, NyPost, and much more.

Feel free to contact him at jacob@bedbible.com.

Market Analysis

This statistic, based on more than 6,000 data points, is useful for industry players, investors, and anyone seeking to understand the dynamics of the personal lubricant market.

Key Takeaways

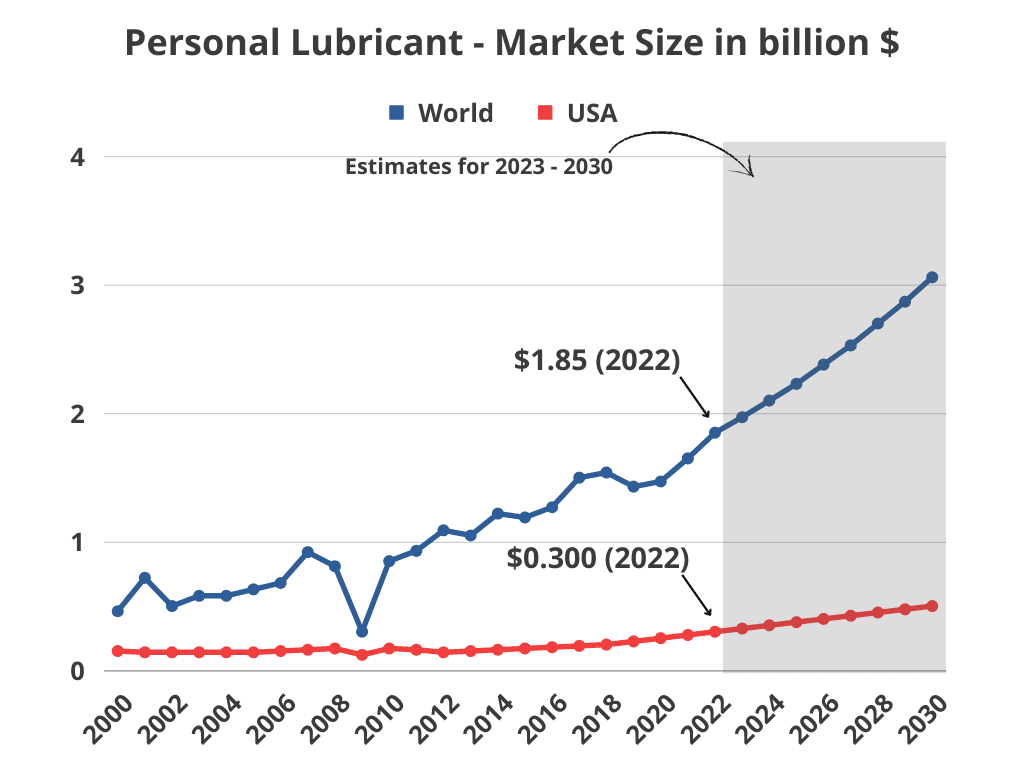

- $1.85 billion is the yearly revenue generated from the selling of personal lubricants. The market in the USA is estimated to generate $300.8 million.

- The industry is expected to keep growing with a CAGR of 6.5% until 2030.

- Water-based lube accounts for 40% of the sales, Silicone-based lube accounts for 20%, oil-based lube accounts for 15%, and the rest 25% is other variants of lubricants.

- Water-based lubricants are generally considered the safest and most versatile option. Oil-based lubricants can damage latex condoms and increase the risk of STIs.

- 43% of American adults have used a personal lubricant at some point in their lives, and 16% reported using one within the last month. The world average for having tried using lubricant is 59%.

- Women are 2x more likely to use lubricants than men.

- Older adults are 1.5x more likely to use lube than younger adults.

- Online retailers accounted for the largest share of sales, followed by drugstores.

- 22% used lube every time they had sex, while 32% used it most of the time.

- 29% sought out lubricants without parabens, and 25% reported seeking out lubricants without glycerin.

- Men who used lubricants were more likely to use condoms consistently and were less likely to experience condom breakage or slippage.

- 60% of LGBTQ+ adults reported using personal lubricants, compared to 37% of heterosexual adults.

- 8 out of 10 gay men have bought and used lube for sexual activities.

- 5 out of 10 millennials (born 1980-1995) have bought and tried lubricant.

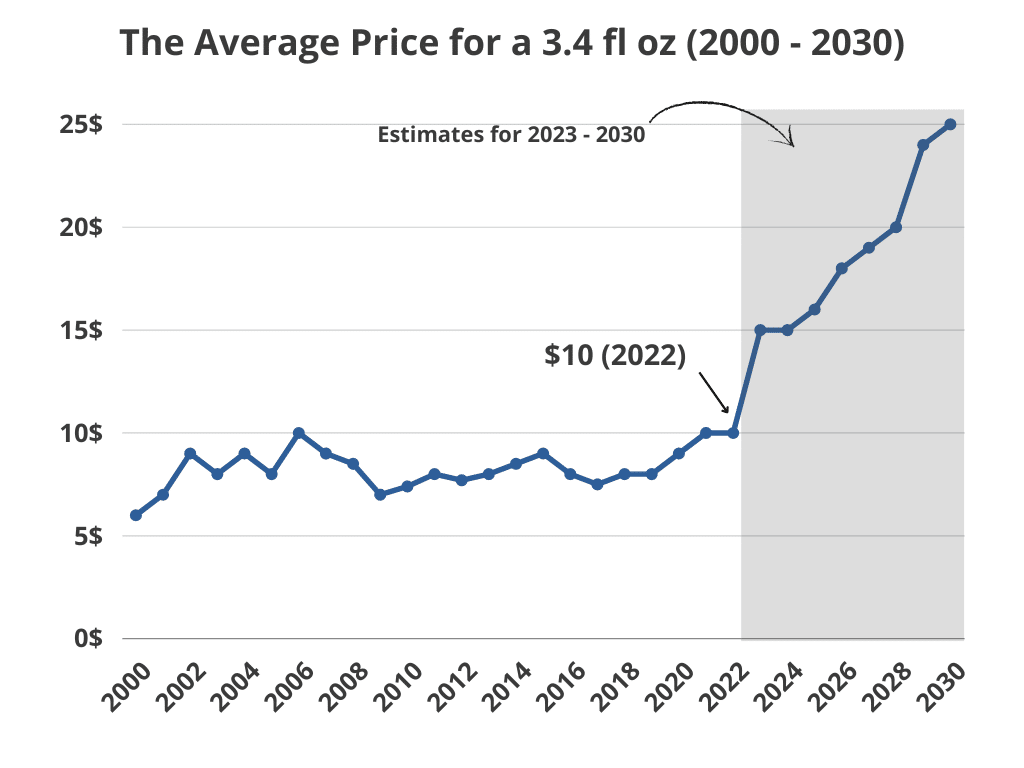

Personal lube prices; the development

In the early days of personal lubricants, there were relatively few options available, and prices were generally higher than they are today. This was partly due to the limited availability of lubricants and the fact that they were often only sold in specialty adult stores.

However, with the proliferation of lubricant brands and the increased availability of personal lubricants in mainstream stores, prices have generally become more competitive. As the market has become more crowded, some brands have tried to differentiate themselves by offering premium lubricants at higher prices, while others have focused on offering lower-priced options to appeal to more budget-conscious consumers.

Here are the actual prices for the most popular types of lubricants:

| Product | Price Range (USD) |

|---|---|

| Water-Based Lubricant (4 oz) | $5 – $15 |

| Silicone-Based Lubricant (3 oz) | $10 – $25 |

| Oil-Based Lubricant (4 oz) | $10 – $20 |

| Hybrid Lubricant (3 oz) | $10 – $20 |

The below graph shows the development in prices for a 3.4 fl oz lubricant (Consumer price index is taken into consideration).

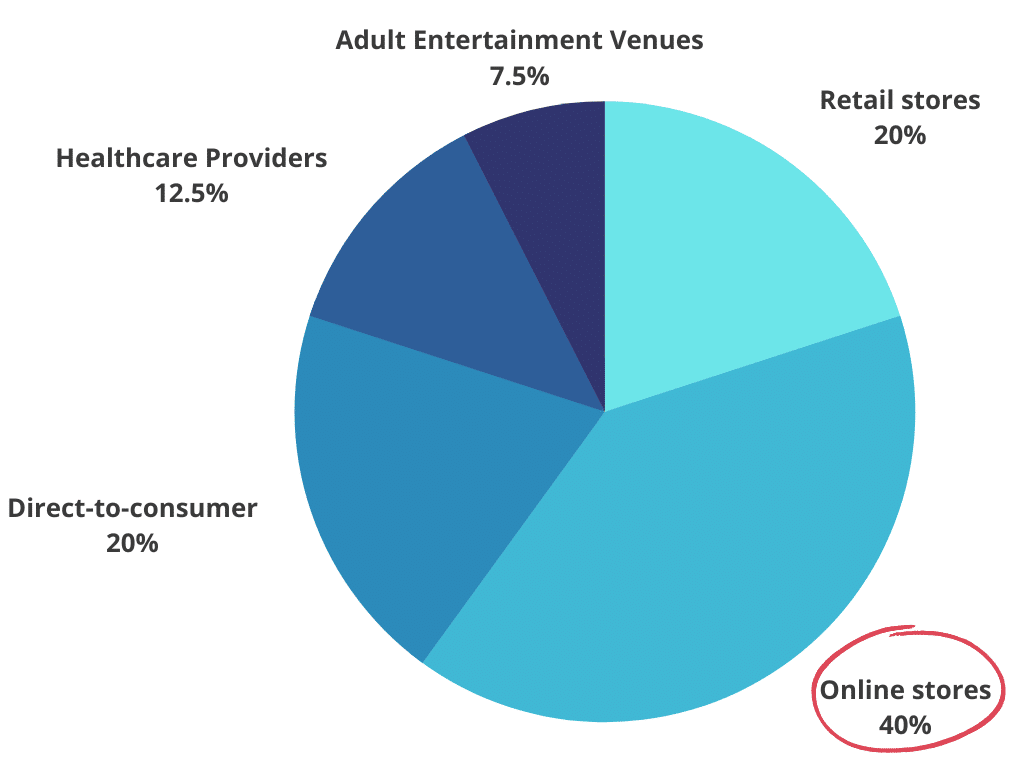

Distribution channel

When it comes to sales distribution channels, personal lubricants are typically sold through the following channels:

Retail stores (20%)

Personal lubricants are widely available at brick-and-mortar retail stores such as drug stores, grocery stores, and sex shops. These stores typically carry a range of lubricants from different brands and types.

Online stores (40%)

The rise of e-commerce has made it easier to purchase personal lubricants discreetly and conveniently. Many online stores specialize in selling sex-related products, including personal lubricants.

Direct-to-consumer (production companies) (20%)

Some companies sell their personal lubricants directly to consumers through their own websites. This allows them to have more control over the customer experience and branding.

Healthcare providers (12.5%)

Medical professionals, such as gynecologists, may recommend personal lubricants to their patients. In some cases, healthcare providers may also sell lubricants directly to patients.

Others, such as Adult entertainment venues (7.5%)

Personal lubricants are commonly used in the adult entertainment industry. As a result, some adult entertainment venues may sell personal lubricants to their customers.

By region

Here we have an overview of the regions of the world and how the sales of lube are distributed. As it appears below is North America the region with the highest demand. The region with the highest Compound Anual Growth Rate is Middle East & Africa. This is primarily because it’s compared to the other region is a relatively new product there.

| Region | Sales in $ million | CAGR (2000-2030) |

|---|---|---|

| North America | 522.875 | 5.8% |

| Europe | 460.35 | 6.1% |

| Asia Pacific | 424.325 | 7.0% |

| Latin America | 135.025 | 6.9% |

| Middle East & Africa | 103.9 | 7.6% |

| Rest | 204.23 | 6.4% |

| Total | 1,850 | 6.5% |

By country

Here we have listed the top 40 countries in the world with the highest sales of lube. And as we can see, the USA is the country that sells the most lube. On the other end, we find countries like Israel and Saudi Arabia where the same sentiment towards sexual wellness is not as widespread.

| Country | Sales in $ million | CAGR (2000-2030) |

|---|---|---|

| United States | 300.8 | 5.7% |

| China | 89.4 | 8.4% |

| Japan | 56.2 | 4.9% |

| Germany | 48.6 | 5.5% |

| France | 36.8 | 5.9% |

| United Kingdom | 35.2 | 5.3% |

| Canada | 26.9 | 5.9% |

| South Korea | 22.3 | 7.8% |

| Australia | 19.5 | 6.8% |

| Brazil | 19.0 | 6.9% |

| Russia | 16.5 | 6.5% |

| Mexico | 15.8 | 7.0% |

| Spain | 15.3 | 5.7% |

| Italy | 14.6 | 5.1% |

| India | 14.1 | 8.2% |

| Poland | 12.5 | 5.6% |

| Indonesia | 11.8 | 9.1% |

| Netherlands | 10.7 | 5.4% |

| Turkey | 10.4 | 6.4% |

| Switzerland | 9.9 | 5.2% |

| Sweden | 8.7 | 5.3% |

| Belgium | 8.5 | 5.1% |

| Thailand | 7.9 | 8.5% |

| Norway | 7.6 | 5.7% |

| Austria | 7.4 | 5.3% |

| Denmark | 6.8 | 5.4% |

| Argentina | 6.5 | 6.9% |

| South Africa | 6.2 | 7.0% |

| Czech Republic | 5.9 | 5.7% |

| Malaysia | 5.6 | 8.2% |

| Portugal | 4.9 | 5.6% |

| Finland | 4.8 | 5.5% |

| Greece | 4.6 | 5.3% |

| Philippines | 4.5 | 9.5% |

| Egypt | 4.1 | 7.1% |

| Chile | 3.9 | 7.0% |

| Hungary | 3.6 | 6.0% |

| Romania | 3.4 | 6.4% |

| Saudi Arabia | 3.3 | 8.1% |

| Israel | 3.1 | 6.7% |

By State

Looking into the United States of America we can see that California ($28 million) is the State where most Lube is being bought. Number 2 state is Texas ($27.3 million) and number 3 is Florida ($19.5 million).

Wyoming and Vermont are the states in the US with the lowest sales of personal lube ($1.5 million).

| State | Sales in $ million |

|---|---|

| Alabama | 5.0 |

| Alaska | 1.9 |

| Arizona | 7.9 |

| Arkansas | 3.3 |

| California | 28.0 |

| Colorado | 6.2 |

| Connecticut | 5.5 |

| Delaware | 2.1 |

| Florida | 19.5 |

| Georgia | 11.1 |

| Hawaii | 2.6 |

| Idaho | 3.1 |

| Illinois | 12.2 |

| Indiana | 6.9 |

| Iowa | 3.8 |

| Kansas | 3.1 |

| Kentucky | 5.5 |

| Louisiana | 6.0 |

| Maine | 2.4 |

| Maryland | 6.7 |

| Massachusetts | 8.4 |

| Michigan | 8.9 |

| Minnesota | 6.0 |

| Mississippi | 4.5 |

| Missouri | 7.8 |

| Montana | 1.9 |

| Nebraska | 2.9 |

| Nevada | 4.9 |

| New Hampshire | 2.6 |

| New Jersey | 10.4 |

| New Mexico | 3.8 |

| New York | 16.3 |

| North Carolina | 10.4 |

| North Dakota | 1.6 |

| Ohio | 11.2 |

| Oklahoma | 5.5 |

| Oregon | 6.2 |

| Pennsylvania | 11.9 |

| Rhode Island | 1.9 |

| South Carolina | 6.2 |

| South Dakota | 2.2 |

| Tennessee | 7.8 |

| Texas | 27.3 |

| Utah | 4.0 |

| Vermont | 1.5 |

| Virginia | 8.3 |

| Washington | 8.9 |

| West Virginia | 3.4 |

| Wisconsin | 6.5 |

| Wyoming | 1.5 |

| Total Sales | 300.8 |

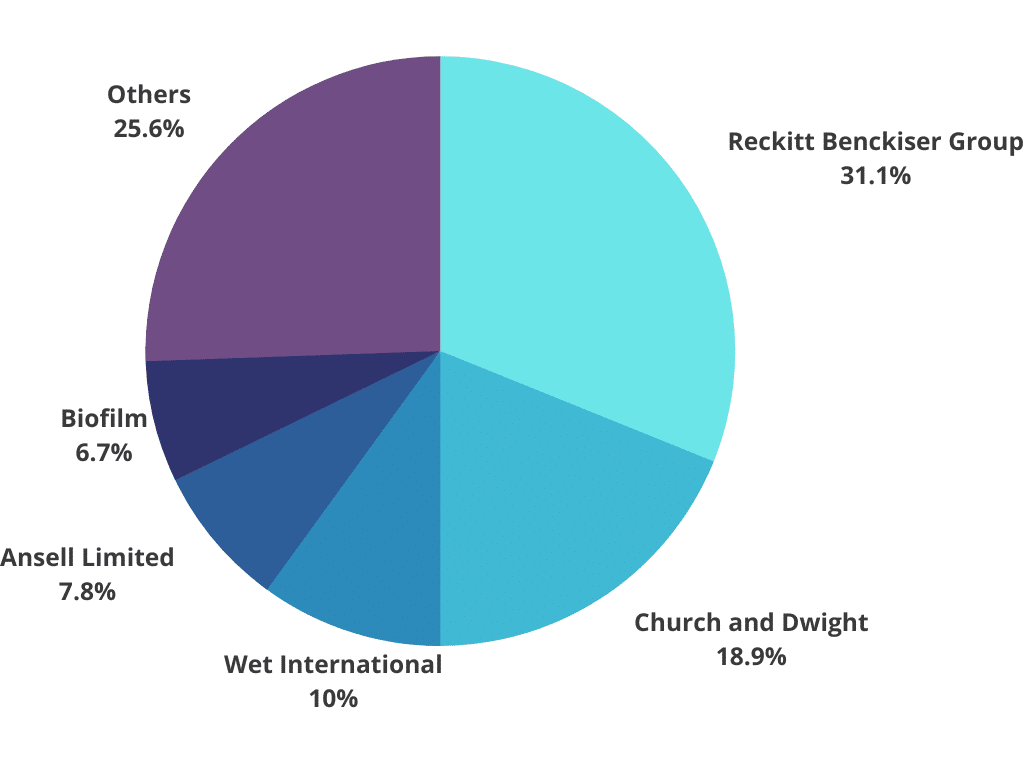

Biggest lube companies (Market share)

Reckitt Benckiser Group (KY & Durex)

KY & Durex is the most well-known brand of personal lubricant and is estimated to have a market share of 28%. The company is a global consumer goods company that produces a wide range of health, hygiene, and home products. Their KY and Durex brand offers a range of personal lubricants for different needs, including water-based, silicone-based, and warming lubes.

Church & Dwight (Trojan)

Trojan is primarily known for its condoms, but the company also produces a range of personal lubricants. The company is estimated to have a market share of 17%. Their lubricant products include water-based, silicone-based, and hybrid lubes. Trojan also offers specialty lubes, such as tingling and warming varieties.

Wet International

Wet International is a company that specializes in personal lubricants and is estimated to have a market share of 9%. The company produces a wide range of personal lubricants, including water-based, silicone-based, and hybrid lubes. They also offer specialty lubes, such as flavored and warming varieties.

Ansell Limited (LifeStyles)

Ansell Limited is a global company that produces a wide range of health and safety products, including condoms and personal lubricants. Their LifeStyles brand is estimated to have a market share of 7%. The company offers a range of personal lubricants, including water-based, silicone-based, and natural lubes.

BioFilm (Astroglide)

Astroglide is a popular brand of personal lubricant produced by BioFilm. The company is estimated to have a market share of 6%. Their lubricant products include water-based, silicone-based, and natural lubes. Astroglide also offers specialty lubes, such as flavored and warming varieties.

Market opportunities & Barriers to entry

There are several key drivers behind the personal lubricant industry’s expansion. One major factor is changing societal attitudes towards sexual wellness, with many consumers placing greater emphasis on enhancing intimacy and pleasure in their sexual experiences. Additionally, growing awareness of the benefits of personal lubricants for sexual health and comfort has contributed to increased demand for these products.

However, manufacturers and distributors face several challenges in meeting this growing demand. One of the main challenges is the lack of regulatory oversight in many regions, which can lead to quality control issues and inconsistent product standards. Additionally, the stigma surrounding the use of personal lubricants can make it difficult for manufacturers and retailers to effectively market their products and reach consumers.

Another challenge is competition from a growing number of new entrants to the market, which can lead to price pressure and lower profit margins. As a result, manufacturers and distributors must constantly innovate and differentiate their products to stay ahead of the competition.

Overall, while the personal lubricant industry presents significant opportunities for growth, manufacturers and distributors must navigate these challenges in order to capitalize on the market’s potential.

Enhancing Intimacy with the Right Lubricants and Sex Toys

The personal lubricant industry has seen a significant surge in recent years, emphasizing the importance of sexual wellness and the role of lubricants in enhancing intimacy.

Just as lubricants play a pivotal role in ensuring comfort and pleasure, sex toys have also emerged as tools that can elevate the sexual experience.

When combined, the right lubricant and sex toy can lead to unparalleled pleasure.

Selecting the Best Lube for Your Sex Toy

- ID Glide: Known for its smooth texture and long-lasting formula.

- Sliquid: A versatile lube that’s compatible with most toys.

- Best Lubes for pH Balance: Ensure safety and comfort with pH-balanced lubricants.

- Best Water-Based Lubes: Ideal for silicone toys and easy cleanup.

Sex Toys That Pair Well with Lubricants

- Vibrator: Enhance the sensation with a slick lube.

- Fleshlight: Ensure a realistic feel with the right lubricant.

- Male Masturbators: Maximize pleasure with a smooth glide.

Specialty Lubricants for Unique Experiences

- Fisting Lube: For those seeking a more intense experience.

- Fake Cum: Add a touch of realism to your play.

- Edible Lube: Combine taste and pleasure.

- Anal Numbing Lube: Ensure comfort during anal play.

Safety First: Lubricants and Toy Care

It’s essential to ensure that the lubricant you choose is compatible with your toy material. Silicone-based lubricants, for instance, should not be used with silicone toys. Regular cleaning of toys and using the right lube can ensure longevity and safety.